Taming the Risk Hydra: Stardog and the Future of BCBS-239 Compliance

Get the latest in your inbox

Get the latest in your inbox

BCBS-239, issued by the Basel Committee on Banking Supervision, establishes principles for effective risk data aggregation and risk reporting (RDARR). It was developed in response to the 2008 financial crisis, highlighting how poor data quality and fragmented systems hampered banks’ ability to manage risk. These principles apply to globally systemically important banks (G-SIBs) and, increasingly, to domestic systemically important banks (D-SIBs).

The goal is to ensure that risk data is accurate, complete, timely, and available across the enterprise. Compliance enables better decision-making, improved governance, and enhanced stress-testing capabilities. Non-compliance exposes firms to regulatory scrutiny, operational inefficiencies, and reputational risk, along with fines and penalties aligned to these failures.

Despite its introduction in 2013 with an initial compliance expectation in 2016, many banks have struggled to fully implement its principles. As of 2023, only 2 out of 31 assessed G-SIBs were deemed fully compliant, underscoring widespread challenges in data governance and IT infrastructure modernization.

In 2024, regulatory penalties were issued to several high-profile institutions for deficiencies in risk data management. The message is clear: BCBS-239 is not aspirational, it’s foundational.

To meet this mandate, banks must go beyond incremental improvements. They must modernize their data architectures, elevate data quality controls, and operationalize a culture of data accountability at scale

Traditional data architectures weren’t designed for cross-functional risk aggregation or granular auditability. They were built to optimize transactions, not transparency. The result? Critical risk data lives across dozens, sometimes hundreds of siloed systems. These systems often have conflicting definitions and inconsistent update cycles, making management a nightmare for impacted institutions.

As a result of these challenges, compliance in recent years has not been satisfactory and that increased measures on the part of the supervisory authorities are to be expected to accelerate implementation.

To achieve BCBS-239 compliance, organizations don’t just require access to data, they demand semantic understanding of data. Without a unifying layer of meaning, attempts to standardize reporting and metadata across entities, geographies, and risk types fail fast, or become so brittle they collapse under pressure.

Stardog Voicebox is an enterprise AI assistant powered by our award winning Resource Description Framework (RDF) compliant knowledge graph engine purpose-built for complex data ecosystems. Leading financial institutions use this solution to unify siloed risk data, trace it from origin to report, and interrogate it using natural language, all without hallucinations, without IT bottlenecks, and without replacing their existing systems.

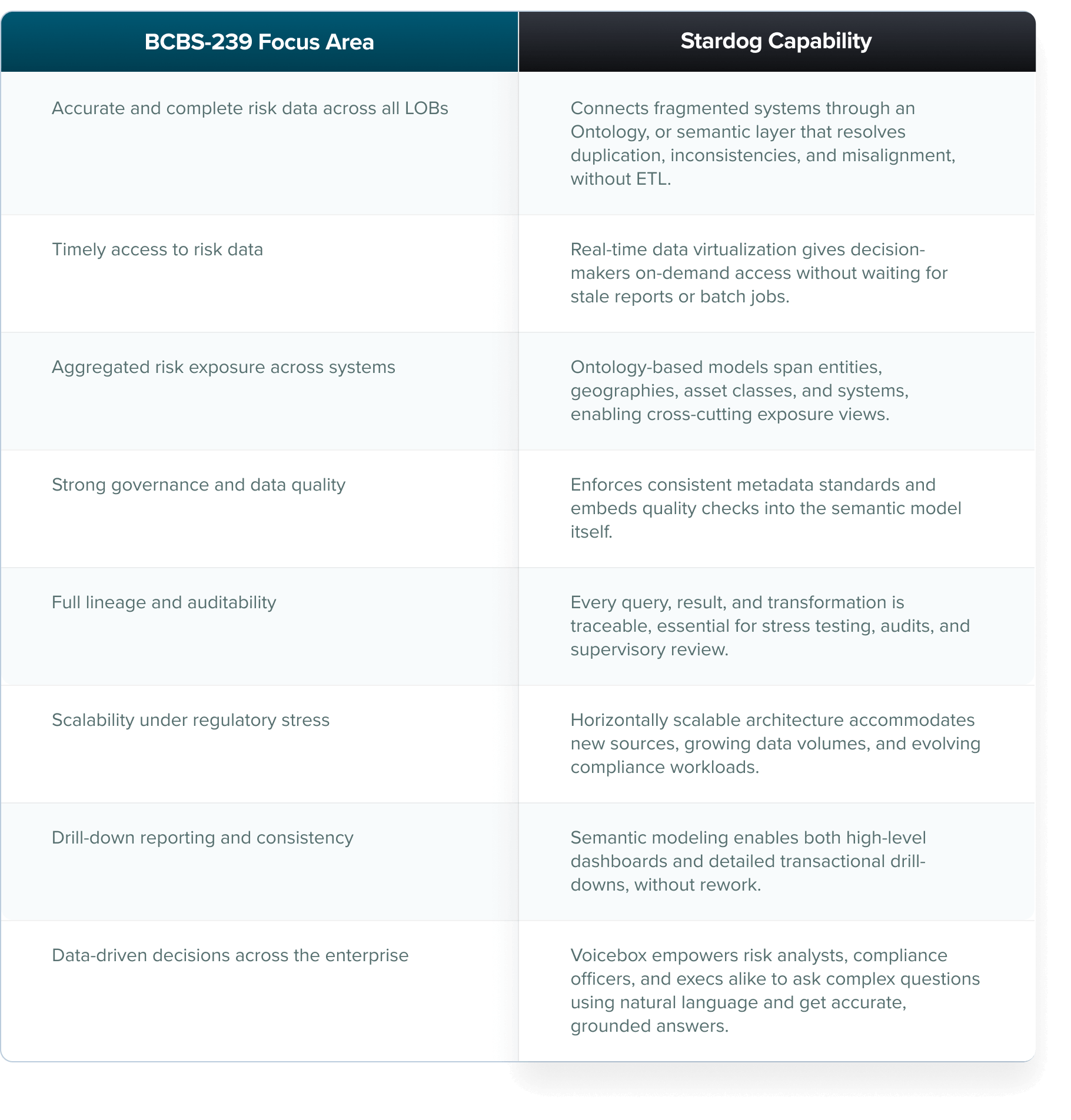

Specifically to BCBS-239 mandates, here is how the Stardog platform aligns to key focus areas:

BCBS-239 compliance is more than a checkbox, it’s a driving force within financial services enabling the modernization of data management, risk measurement, and decision making. The institutions that treat it as a strategic catalyst, not just a compliance burden will gain a durable edge.

Stardog helps leading organizations realize that edge. By aligning data to meaning, aligning meaning to users, and aligning users to outcomes, Stardog transforms BCBS-239 from a burden into a blueprint for digital resilience.

Let’s talk. If you’re navigating BCBS-239, or any regulatory data challenge, Stardog can help.

How to Overcome a Major Enterprise Liability and Unleash Massive Potential

Download for free